The practice of using business models from previous times does not follow disciplined business methods. It’s a slow leak in revenue, relevance, and resilience. Market changes cause legacy pricing methods and distribution channels and value creation approaches to lose their ability to generate increasing returns. The regular operations of corporations maintain outdated business models until an unexpected event reveals their outdated structure.

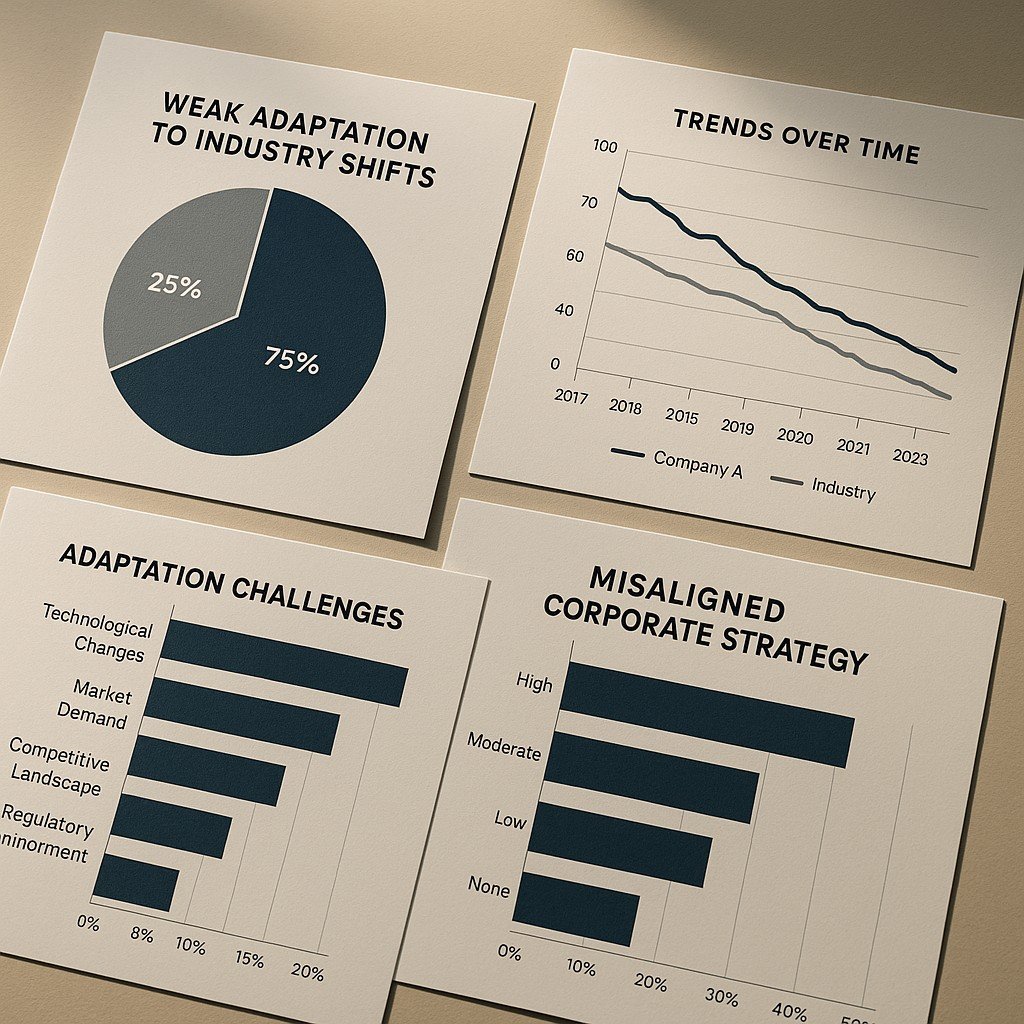

The risk is visible in the numbers

CEOs already understand that their organization faces an impending collapse. In PwC’s 2025 Global CEO Survey, four in ten believe their company won’t be viable in ten years if it stays on its current path. The last five years show that new business revenue accounts for only 7% of total revenue because most companies have not achieved sufficient innovation speed.

Profit pools are migrating, too. The payments industry has experienced a shift where basic processing functions have become standardized yet businesses now focus on software-based payment solutions and financial integration and additional service offerings. The model will experience margin reduction because it depends solely on volume and interchange data for its predictions.

AI technology transforms both the locations where value gets created and the methods through which value gets generated. McKinsey finds more companies now report increased revenue within business units using generative AI. The benefits of AI implementation will go to organizations which transform their operational systems and establish specific performance indicators instead of those who attempt to add AI to their current systems.

Sustainability requires organizations to make a similar transition. The Bain/WEF survey shows that manufacturing leaders expect circular solutions to increase their revenue by more than 70% during 2027 while 65% of them predict these solutions will improve their operational stability. Linear “sell-and-forget” models will lose to “use, recover, and resell” models that lock in customers and materials.

GCC context: short-term confidence, long-term urgency

The GCC demonstrates positive outlook but faces more significant obstacles because of reinvention requirements. The 2025 Middle East research by PwC reveals that GCC CEOs believe their businesses need to transform within the next decade to survive at a rate higher than worldwide averages at 64%. The fast pace of AI development and climate policies and regulatory changes requires immediate action because delay will result in higher expenses in this market.

Translate that into action on Saudi timelines. The telecommunications industry will transition from providing basic connectivity services to offering financial technology packages while utility companies will start providing electric vehicle charging services and flexible service options and banks will integrate financial services into their software platforms. The winners reach their national objectives by implementing business models which produce fast growth.

How outdated models show up on the ground

First, you sell products, not outcomes. The payment system of contracts bases its calculations on the number of units delivered instead of the actual time period of operation. The pricing system operates with a set format which demands customers to pay full costs at the beginning of their buying process. Third, distribution operates through a single channel which remains fragile because new platforms that connect customers to products will cut off your access and steal your data. The practice of innovation takes place in pilot operations instead of through financial performance reports.

The observed patterns point to a problem with the model rather than any issue with marketing operations.

A functional operating system exists to transform your current system design.

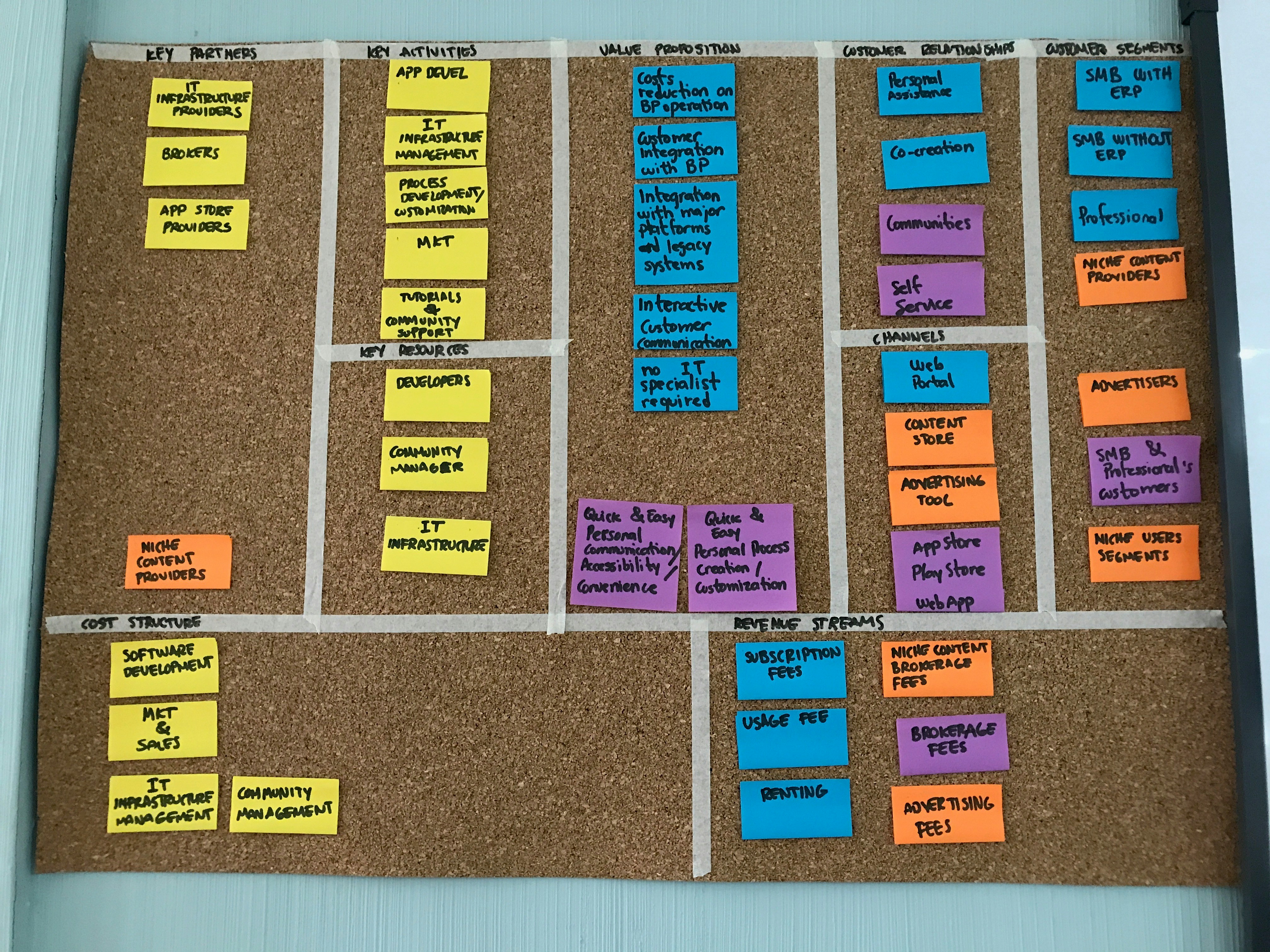

1) Map where value will move.

Run a two-week “profit-pool scan” for your sector. The expansion of margins happens through software-wrapped services and platform-based models and usage-based pricing structures. The analysis starts with external trend markers which show payments will shift to embedded finance before it identifies specific business line weaknesses.

2) Select one future model for each core business operation.

Select the single model which provides customers with the strongest lock-in and defensive position through subscription or usage-based or outcome-based or marketplace or circular take-back models. The circular data benefits your business when you perform asset manufacturing and equipment-as-a-service testing and refurbishment operations.

3) Redesign the workflow, not just the wrapper.

Organizations show AI value through their operational adjustments which monitor performance indicators instead of implementing chatbots. The monetization logic requires definition of take rate and attach and utilization rates and the new value unit and data flywheel operation. Set a 90-day redesign sprint for one customer journey.

4) Fund like a portfolio.

The organization should reserve 10–15% of operational expenses for new-model bets which must have defined termination points. Stage-gate on paying users, gross margin, retention, not lines of code. Shift 5–10% of sales comp to the new offer to force focus.

5) Stand up go-to-market in parallel.

Don’t wait for “perfect.” Launch with a lighthouse segment, a clear price metric, and success guarantees. Your software should provide integrated services to enterprise customers for easy transition while SMBs can use it to connect with their current customer network.

6) Measure what the board cares about.

Track mix shift—revenue from new models as a share of total—and gross margin uplift from services. The analysis requires addition of customer payback time and attach rate and net revenue retention metrics. The company needs to shut down or adjust these projects when they fail to show progress during quarter two.

Example plays by sector (GCC-friendly)

- Industrial & energy: The company needs to transform its business operations by moving from selling CAPEX products to offering outcome-based contracts which provide uptime warranties and energy optimization and equipment renewal services. The revenue model of circular business generates higher customer retention and better market disruption resistance. (Bain)

- Financial services & payments: The integration of payments into vertical software applications enables businesses to offer reconciliation and payouts and risk management solutions as additional services. Avoid commodity acquiring without software.

- Retail & consumer: The system needs to have membership levels which provide users with delivery services and financial benefits and return policies. Use AI to optimize demand shaping and personalization within the new value metric. (McKinsey & Company)

Governance: keep it small, weekly, and visible

Create a Model Reinvention Room that meets 30 minutes each week. The system requires one page for each bet which includes problem identification and model development and KPI trend analysis and next proof point identification and blocker identification. We will distribute a Friday note which contains our testing results and learned information and details about Monday system modifications. Momentum beats theater.

If you remember one thing

The past corporate business models stay concealed until their complete collapse becomes visible to everyone. The evidence shows that viability windows are becoming shorter while profit pools are shifting toward new areas and AI together with circularity systems benefit organizations which transform their value creation and delivery methods. Begin with minimal changes that you will implement each week while tracking specific revenue performance indicators. (PwC)

References:

Internal Links

https://3msbusiness.store/when-the-market-moves-faster-than-you-the-real-cost-of-slow-adaptation/

https://3msbusiness.store/securing-essential-profit-pools-to-combat-declining-profits/

External Links

- External 1 — PwC, 28th Annual Global CEO Survey (2025). (PwC)

- External 2 — BCG, 2025 Global Payments Report (2025).

- External 3 — McKinsey, The State of AI: Global Survey (2025). (McKinsey & Company)

- External 4 — Bain, Circular Business Models Unlock New Profit and Growth (2025). (Bain)

- External 5 — PwC Middle East, 28th CEO Survey: Middle East findings (2025). (PwC)

Get an extra 20% discount upon subscription at Hostinger webhosting: