When the Market Moves Faster Than You: The Real Cost of Slow Adaptation

Leaders fail because of a single poor concept only in exceptional circumstances. The company fails because the world keeps evolving while the organization remains stagnant. Previous business strategies now function as obstacles to present-day operations because companies fail to adapt to changing industries. Revenue decays. Margins compress. Talent leaves for faster ships. The system requires better sensing abilities and faster decision-making and budget adjustments that keep pace with market speed.

The cost of slow adaptation

The value chain undergoes changes when customers begin to adopt new behaviors. Your forecasts will fail because your plan continues to use the outdated chain assumption. The GCC has experienced this transformation through digitalized logistics operations and financial technology infrastructure development and energy sector supply chain modernization. The companies which delayed their entry into the market lost their market share regardless of their size. The business model fails to adapt properly to industry changes at work because it makes small errors repeatedly until it no longer matches the market.

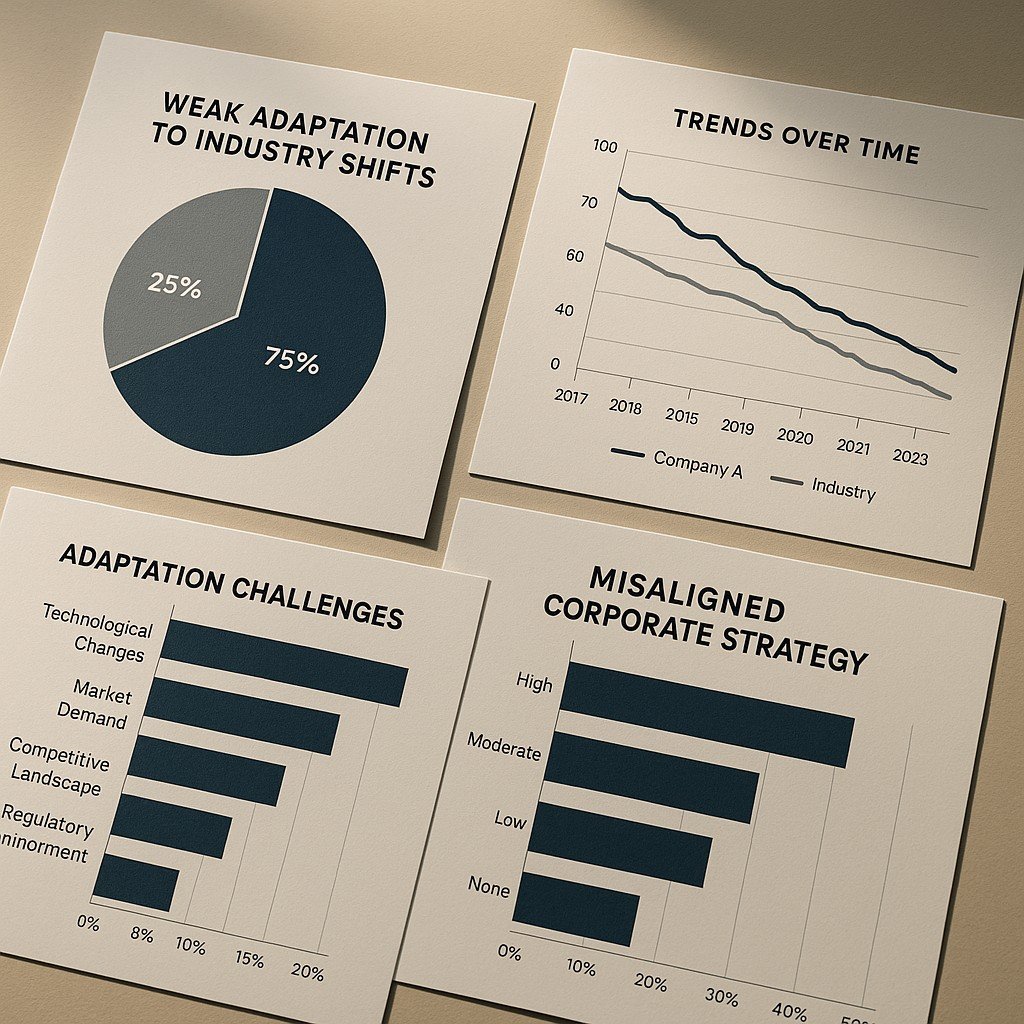

Two signals matter. Your revenue distribution maintains the same pattern from two years ago yet your competitors have made changes to their revenue streams. The market operates at a faster pace yet production cycles extend their duration. If both are true, you are in weak adaptation to industry shifts territory.

1) Spot it early: clear, simple signals

Revenue mix frozen. Your business strategy becomes outdated because 80% of your revenue still comes from traditional products although market trends now favor new products. Watch the share of sales from new products launched in the last 24 months.

Slow product clock-speed. If idea-to-launch takes 12–18 months in a six-month market, you will lose. Track concept-to-cash time every quarter.

Talent and tools mismatch. Your organization will maintain poor market adaptation when you select traditional candidates because the industry demands professionals who understand data and product development and platform management. Measure critical-skill fill rate and productivity per head.

2) Why it happens: root causes you can fix

Annual strategy theater. Many organizations use annual slide presentations as their main method to execute their strategic plans. Markets do not. The 12-month decision lock prevents organizations from making timely adjustments to market changes.

The current reward systems function through systems that have become outdated. The current bonus system gives rewards based on legacy unit numbers which would prevent players from moving their resources. The compensation system should link rewards to new revenue generation and both market launch speed and performance across different business units.

Data without decisions. Dashboards do not function as strategic tools. Determine the essential boundaries which activate the need to take action. The lack of these factors leads to continued poor adaptation to industrial changes.

3) The 90-day adaptation playbook

You do not need a revolution. You need a tight loop.

Sense (Weeks 1–3).

The team should conduct an outside-in analysis once per week by analyzing customer actions and competitor actions and regulatory changes. KSA businesses need to track local content regulations and industrial development plans under Vision 2030 while UAE businesses should monitor Operation 300bn’s effects on manufacturing clusters. Use one page. The study’s main results need to be presented in the last section together with their important implications.

Decide (Weeks 4–6).

The team needs to establish a portfolio board which will meet twice per month. You should place three different types of wagers which include core upgrades and adjacent plays and options. The company bases its capital expenditure choices on present requirements instead of previous patterns. The system stops organizations from making poor adjustments to industry changes because it bases funding decisions on performance results.

Mobilize (Weeks 7–12).

Shift 5–10% of OPEX/CAPEX to new bets immediately. Freeze low-return features. Stand up two cross-functional “mission teams” with a general manager, product, tech, finance, and legal. Every mission needs to have three performance indicators which serve as success measurement tools. Keep scope small, speed high.

4) Metrics that make adaptation real

Time-to-respond. Days from external shock to a funded action. Target <30 days.

% of revenue from new products. Fast markets need to achieve a 15–25% growth objective during the following 24 months.

Budget mobility. Share of spend reallocated in-year. Healthy firms move 10–20%.

Decision latency. Time from insight to decision. Measure it; reduce by half.

Capability index. Skills coverage for priority domains. Close gaps quarterly.

The data shows that the industry is not ready for transition but there is evidence of progress in both board member and financial institution areas.

5) GCC example: a practical pivot, not a press release

A mid-market industrial player in Saudi Arabia made metal components for oil services. The market demand moved toward clean-tech enclosures together with EV supply components. The company demonstrated poor ability to adjust to changing industry conditions because its revenue stayed flat while its inventory grew and its product turns became slower.

They operated the 90-day cycle. The team made changes to the parts production line near batteries during six weeks and joined forces with a local logistics technology company to reduce delivery times by 20%. The company allocated 12% of their capital expenditure budget to start new projects and employed two mechatronics engineers while shutting down three unprofitable product lines. In nine months, 18% of revenue came from the new line, and EBITDA rose 250 bps. It was not flashy. It was disciplined.

6) Governance: make adaptation the default

Your operating model needs to establish three fundamental operational practices.

Rolling strategy. The system needs to reset on a quarterly basis instead of following an annual cycle. Maintain a single-page strategy document which outlines specific exit conditions for each bet.

Budget on rails. Pre-approve reallocation rules up to a threshold. The financial system functions as a speed-enhancing mechanism which drives progress rather than obstructing it.

Board cadence. Add a standing “market shifts” agenda item. Tie CEO/EXCO incentives to the adaptation metrics above. The system prevents organizations from reverting to poor adaptation responses to industry changes.

Finally, communicate in plain language. Avoid buzzwords. State your plans for what you will stop, start, and scale. Share the next 90 days. Then do it. Organizations need to transform adaptation into a structured business process instead of treating it as a surface-level marketing term to solve their weak industry shift adaptation problems. Begin with a minimal approach. Move money. Measure speed. Win.

References:

The internal links:

https://3msbusiness.store/navigating-the-strategic-risks-of-pursuing-multiple-market-opportunities/

https://3msbusiness.store/select-competitive-strategy-you-can-implement/

The external links:

The World Economic Forum published The Future of Jobs Report 2023 which can be accessed at https://www.weforum.org/reports/the-future-of-jobs-report-2023/

The World Economic Forum published the Future of Jobs 2023 report as a PDF document which can be accessed at https://www3.weforum.org/docs/WEF_Future_of_Jobs_2023.pdf.

IMF — Regional Economic Outlook: Middle East and Central Asia (2024): https://www.imf.org/en/Publications/REO/MECA

The following resource provides information about digital strategy in the modern business world: McKinsey — Strategy in a digital age: https://www.mckinsey.com/capabilities/strategy-and-corporate-finance/our-insights/strategy-in-a-digital-age

PwC Middle East — Middle East Economy Watch 2024: https://www.pwc.com/m1/en/publications/middle-east-economy-watch.html

Saudi Ministry of Industry & Mineral Resources — National Industrial Strategy (Vision 2030): https://www.investsaudi.sa/en/sectors-opportunities/industries/national-industrial-strategy

Subscribe to Hostinger (web hosting) and get 20% Discount with the following link: